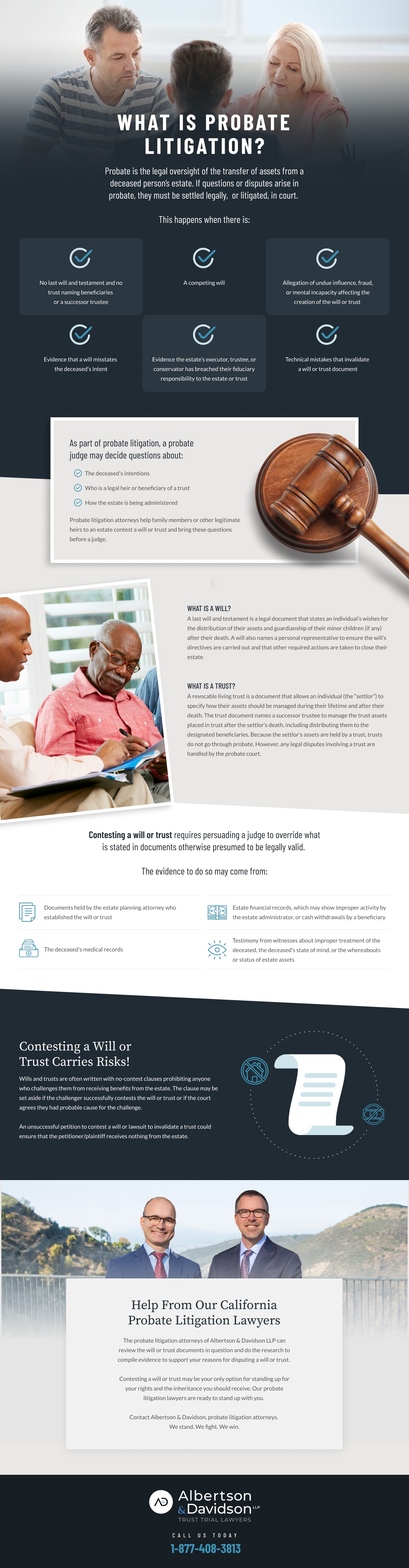

Meet Your Los Angeles Probate Litigation Team

Keith Davidson

With more than two decades of experience in trust and will litigation, Keith Davidson has secured over $300 million in verdicts and settlements. A graduate of Loyola Law School and former law professor, Keith is recognized for his strategic thinking, skilled advocacy, and ability to simplify complex estate disputes for his clients.

Stewart Albertson

A U.S. Army veteran and proven trial lawyer, Stewart Albertson has also helped clients recover more than $300 million in verdicts and settlements. Trained in tax law at Georgetown University and honored by Super Lawyers, Stewart is known for his tenacity in the courtroom and his client-first approach to every case.

Why Choose Albertson & Davidson?

Probate disputes are often emotional and highly personal. At Albertson & Davidson, LLP we focus exclusively on estate and probate litigation, giving each case the attention and dedication it deserves. Clients turn to our firm because:

-

Our lawyers dedicate their practice solely to probate and estate litigation

-

Our proven results include over $300 million recovered for clients

-

We treat every case with the focus, time, and commitment it requires

Schedule your free consultation today to see why families across Los Angeles trust us with their most important probate litigation matters.

Understanding Probate in Los Angeles, CA

Probate is the legal oversight of the transfer of a deceased person’s assets. In many cases, the deceased has left a will that directs how he or she wanted specific assets and personal property distributed.

For example, a will names beneficiaries and what assets they are to receive. A trust appoints a successor trustee who takes over the administration of the trust and its assets.

With will vs without will

- There is a will. It should name an executor, who must file the will with the local probate court. The court will appoint an individual, usually the named executor, to administer the deceased’s estate. This involves ensuring debts and taxes are paid, collecting money owed to the estate, and reporting on the status of the estate to the court as it is dissolved. The executor ensures that the assets of the estate are divided and distributed as required by the will.

- The individual died without a will. The deceased is said to have died “intestate.” The probate court will appoint an administrator who is tasked with identifying legal heirs to the deceased, in addition to settling the estate’s debts and taxes. The probate court will determine how and to whom assets from the estate are to be distributed. The distribution is typically according to a succession of kinship to the deceased, i.e., spouse, children, parents, and then siblings, as required by state law.

In Los Angeles probate often essentially consists of filing probate forms and attesting to their contents in a hearing.

However, when there are disputes about the contents of a will or trust or the actions of the administrator of an estate or a trustee, those with legal claims to portions of the estate have a right to be heard by a probate court.

This is probate litigation. It requires attending a hearing and providing documentation and testimony as evidence to support the claim.