California Financial Elder Abuse Attorney

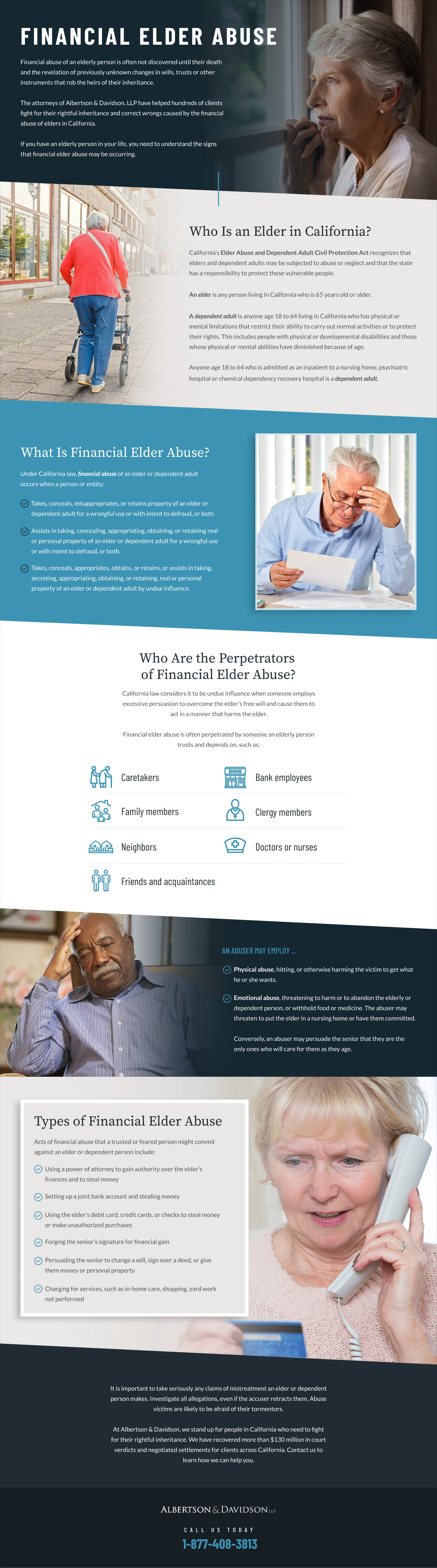

Financial elder abuse affects an estimated 6 million Americans every year.

Financial abuse can occur when you least expect it.

Elderly individuals can easily fall victim to manipulation. People with bad intentions, whether they’re caretakers, friends, neighbors, or even family members, can slowly take control of an elder’s daily needs, medications, and money. By using lies, keeping them isolated, and making threats, these wrongdoers can force seniors to give up their money and property. In extreme cases, they might even create new wills that favor themselves, leaving the real family members out.

Luckily, California has strong laws to help protect senior citizens (those aged 65 or older) from these manipulators. These laws not only stop bad actions but can also fix unfair wills, making sure that assets are transferred to the legitimate family members.

In 2023, California has done even more to help keep the elderly safe. Led by Sen. Bill Dodd, the senate has passed a new law, Senate Bill 278. This new rule puts banks and other institutions that handle money on the spot, making them responsible if they allow elderly people to be taken advantage of. In simple terms, if these places are involved in senior citizens losing their money, on purpose or by accident, they’ll be held accountable.

Our California financial elder abuse attorneys have helped many people in challenging claims of financial elder abuse.

Our California financial elder abuse attorneys have helped many people in challenging claims of financial elder abuse.