Types of Irrevocable Trust in California

Trusts are flexible tools that are commonly used as part of estate planning by California families for parents to pass their assets to children and avoid the probate process. Many inheritance disputes involve irrevocable trusts and the trustees overseeing the trusts. Trust beneficiaries do have legal rights if they suspect trust abuse.

The attorneys at Albertson & Davidson, LLP help individuals, and families in California resolve disputes involving revocable and irrevocable trusts. Our trust contest attorneys understand California laws pertaining to the creation and administration of revocable and irrevocable trusts. We have litigation experience in courtrooms throughout California to represent you effectively in a trust contest. Albertson & Davidson has recovered more than $250 million in court verdicts and negotiated settlements for our clients.

Call (877) 408-3813 to reach a trust contest lawyer. We have offices in Los Angeles, San Diego, Carlsbad, Bay Area, and Irvine. We handle trust contest litigation on a contingency fee basis, so you can obtain skilled legal representation without any upfront costs.

Revocable vs. Irrevocable Trusts in California

A revocable living trust is the type of trust that people typically create during their lifetimes. A revocable trust allows the person who created the trust, known as the settlor, to modify the trust, change the beneficiaries, or even cancel the trust. They can make changes to the trust without having to go to court.

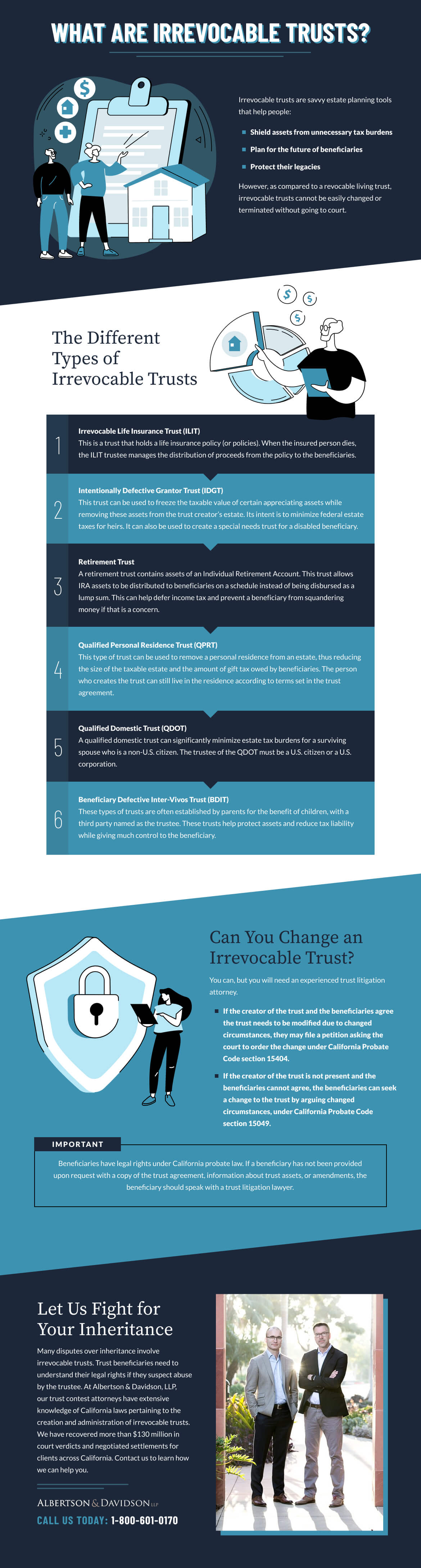

An irrevocable trust, on the other hand, cannot be easily changed or amended or terminated without the approval of the court. The assets placed in the trust are used for the benefit of the named beneficiaries. There are provisions under the California probate code that allow you to ask the court to modify the terms of an irrevocable trust. If the creator of the trust and all the beneficiaries agree that trust needs to be modified due to changed circumstances, they may file a petition asking the court to order the change under California Probate Code section 15404.

If the creator of the irrevocable trust is not present and the beneficiaries cannot agree, the beneficiaries can seek a change to the trust by arguing changed circumstances, under Probate Code section 15049. For example, if the trust precludes the sale of a piece of real estate, but that sale is necessary to provide support for the beneficiary, then that changed circumstance may support modification to the trust.

Beneficiaries of irrevocable trusts do have legal rights under California probate law. The trustee of the trust has a legal responsibility to keep the beneficiaries of the trust reasonably informed of the trust and its administration. If a beneficiary has not been provided upon request with a copy of the trust agreement, information about trust assets, or amendments to the trust, the beneficiary may hire a trust litigation lawyer and ask the probate court to compel the trustee to provide the necessary information.

Irrevocable Trust Types

California law recognizes a number of different kinds of trusts. Some living trust examples are:

- Irrevocable Life Insurance Trust (ILIT): This type of trust is created to own a life insurance policy or policies. The transfer made to fund the ILIT is permanent. The designated trustee of the ILIT manages the distribution of proceeds from the policy to the trust beneficiaries upon the death of the insured.

- Intentionally Defective Grantor Trust (IDGT): This type of irrevocable trust is used to freeze the taxable value of certain appreciating assets and remove them from the trust creator’s estate to minimize estate taxes. It is often created for the benefit of an individual’s spouse, children, or other heirs. This type of trust also may be used to create a special needs trust for a disabled child or adult. The trust is structured so that all income generated by the trust is taxed to the creator of the trust for income tax purposes. While the trust is a grantor trust for income tax purposes, it is designed so that the trust assets are not counted as part of the grantor’s estate for federal estate tax purposes.

- Retirement Trust: This is an irrevocable trust that allows some control over how the assets of an Individual Retirement Account are distributed after the IRA owner passes. Naming a retirement trust as a beneficiary of an IRA can be a useful estate planning tool. Doing so can allow the IRA assets to be distributed on a schedule rather than be disbursed as a lump sum to qualify for deferral of income tax. It also can prevent a spendthrift beneficiary from squandering the proceeds if that is a concern.

- Qualified Personal Residence Trust (QPRT): A QPRT is a type of irrevocable trust that is used in California to remove a personal residence from a person’s estate in order to reduce the size of the taxable estate and the amount of gift tax that is owed when passing assets to children or other beneficiaries. The individual who creates the trust retains the right to live in the residence rent-free for the term of years specified in the trust agreement and to pay all the expenses of maintaining the house. If the individual who established the trust lives beyond the term of the trust, the residence passes to the beneficiaries (for example, the children) or to trusts established for their benefit.

- Qualified Domestic Trust (QDOT): A qualified domestic trust is a type of trust that is useful for estate planning for a married couple that includes a U.S. citizen and a non-U.S. citizen to minimize estate tax consequences. It allows a surviving spouse who is not a U.S. citizen to avoid paying estate taxes on sizable assets inherited from the deceased spouse. Ordinarily, property passing to a surviving spouse who is a non-U.S. citizen does not qualify for the same unlimited estate tax marital deduction. But through careful estate planning, a spouse may place all of his or her assets into a QDOT, which will own the assets upon the first spouse’s death. The QDOT, if set up in compliance with detailed I.R.S. rules, should qualify for the unlimited marital deduction and allow the surviving spouse who is not a citizen to defer paying estate taxes. The surviving spouse can receive all income from the trust. A trustee of the QDOT must be a U.S. citizen or U.S. corporation.

- Beneficiary Defective Inter-Vivos Trust (BDIT): The concept behind this type of trust is that it’s established by a trusted third party for the benefit of the client. A common scenario is for parents to create the trust for the benefit of a child or children. For example, the parents of the client put a certain amount of money into the trust each year, permitting the client to withdraw the amount. The client, who is the beneficiary, pays income tax on the income earned by the trust. The client could convey assets to the BDIT in exchange for a promissory note and shield the asset from capital gains. A BDIT offers protection of assets, control for the beneficiary, and reduces or eliminates federal estate taxes.

The laws governing irrevocable trusts in California are complex. The attorneys at Albertson & Davidson handle cases involving misappropriation of trust assets, failure to abide by terms of the trust, improper or inadequate trust accounting, and other disputes that arise involving trusts and estates. In some cases, filing a trust contest is really your only option to stand up for your rights and fight for your inheritance. We are here to help.

Contact a California Irrevocable Trust Trial Lawyer

The knowledge and litigation experience of the attorneys representing you in a trust dispute can make all the difference in how the matter is resolved. Founding attorneys Stewart Albertson and Keith Davidson at Albertson & Davidson have experienced trial attorneys who focus trust and estate litigation. Our law firm has dozens of trust contest cases in progress at any given time. Our firm’s guiding principles are summarized in the motto: “We stand, we fight, we win.” Our attorneys cannot promise a victory in every irrevocable trust contest, but we can guarantee that our clients will receive our best efforts to achieve success.

We handle many trust contests on a contingency fee basis. That allows you to be represented by experienced trust trial lawyers without having to pay any upfront costs. With a contingency fee arrangement, if our attorneys are successful in negotiating a settlement or securing a court award for you, then we receive a portion of the amount awarded as our legal fee and expenses.

Albertson & Davidson LLP has offices in San Diego, Carlsbad, Bay Area, Irvine, and Los Angeles and handles cases throughout California. Contact us at (877) 408-3813.

Our trust litigation attorneys are ready to fight for you.